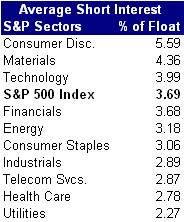

The latest data on short interest, the total number of shares of a security that have been sold short expressed as a percent of total tradable shares, reveals that consumer discretionary stocks have the highest average short interest standing at 5.6 percent.

|

Materials and Technology are the other two sectors with short interest figures greater than the S&P 500 as a whole, 3.69 percent. On the contrary, utilities and health care stocks are the least shorted in the S&P 500.

Investors track short interest levels to gain a sense of where a stock might be headed, along with some insight into whether any positive news might force short-traders to cover their positions, pushing a stock higher.

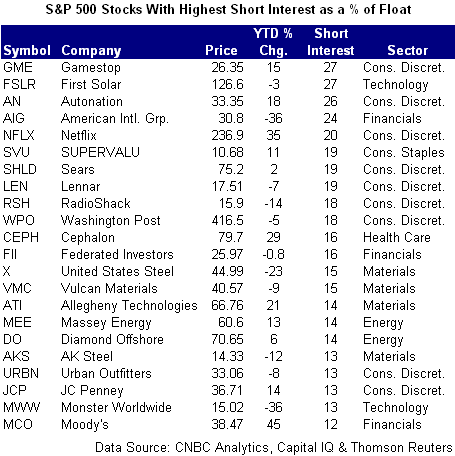

Below is a list of the most heavily shorted stocks in the S&P 500.

|

0 comments